All Categories

Featured

That's not the very same as investing. They will certainly not only want you to purchase the item, they desire you to go into organization with them, join their team. Ask on your own, has this person that's selling this item to me been doing this for five years or at least ten thousand hours' well worth of solutions?

I want you to be an expert, a master of all the expertise needed to be a success. Do not, Manny, if you do this, do not call a good friend or household for the very first 5 years. And afterwards, by the method, you intend to inquire that in the interview.

Variable Universal Life Insurance Quotes

I suggest, that's when I was twenty-something-year-old Brian being in his financing class, and I was checking out, going, 'What do these people do after they finish?' And all of them go job for broker-dealers or insurer, and they're offering insurance coverage. I relocated over to public bookkeeping, and now I'm all thrilled since every parent is typically a CPA that has a child in this evening.

That's where wisdom, that's where understanding, that's where experience comes from, not even if somebody likes you, and now you're gon na go turn them right into a client. For more information, look into our free resources.

I mean, I am a financial services professional that cut her teeth on whole life, but who would embrace this concept focused around purchasing only term life insurance coverage? Granted, term is an affordable kind of life insurance coverage, however it is also a short-term type of coverage (10, 20, 30 years max!).

It makes certain that you have life insurance policy past thirty years regardless of for how long you live, as a matter of fact and depending upon the kind of insurance, your costs quantity might never ever change (unlike eco-friendly term policies). After that there is that entire "invest the difference" thing. It actually rubs me the upside-down.

Keep it real. If for no other reason than the fact that Americans are awful at saving cash, "get term and invest the difference" must be outlawed from our vocabularies. Be person while I go down some understanding on this factor: According to the U.S. Social Safety And Security Management, the ordinary American's annual wage was $42,979.61 in 2011; Yet, just 14.6 percent of American families had liquid possessions of $50,000 or even more throughout that exact same period; That implies that less than 1 in 4 households would have the ability to replace one income-earner's incomes must they be out of work for a year.

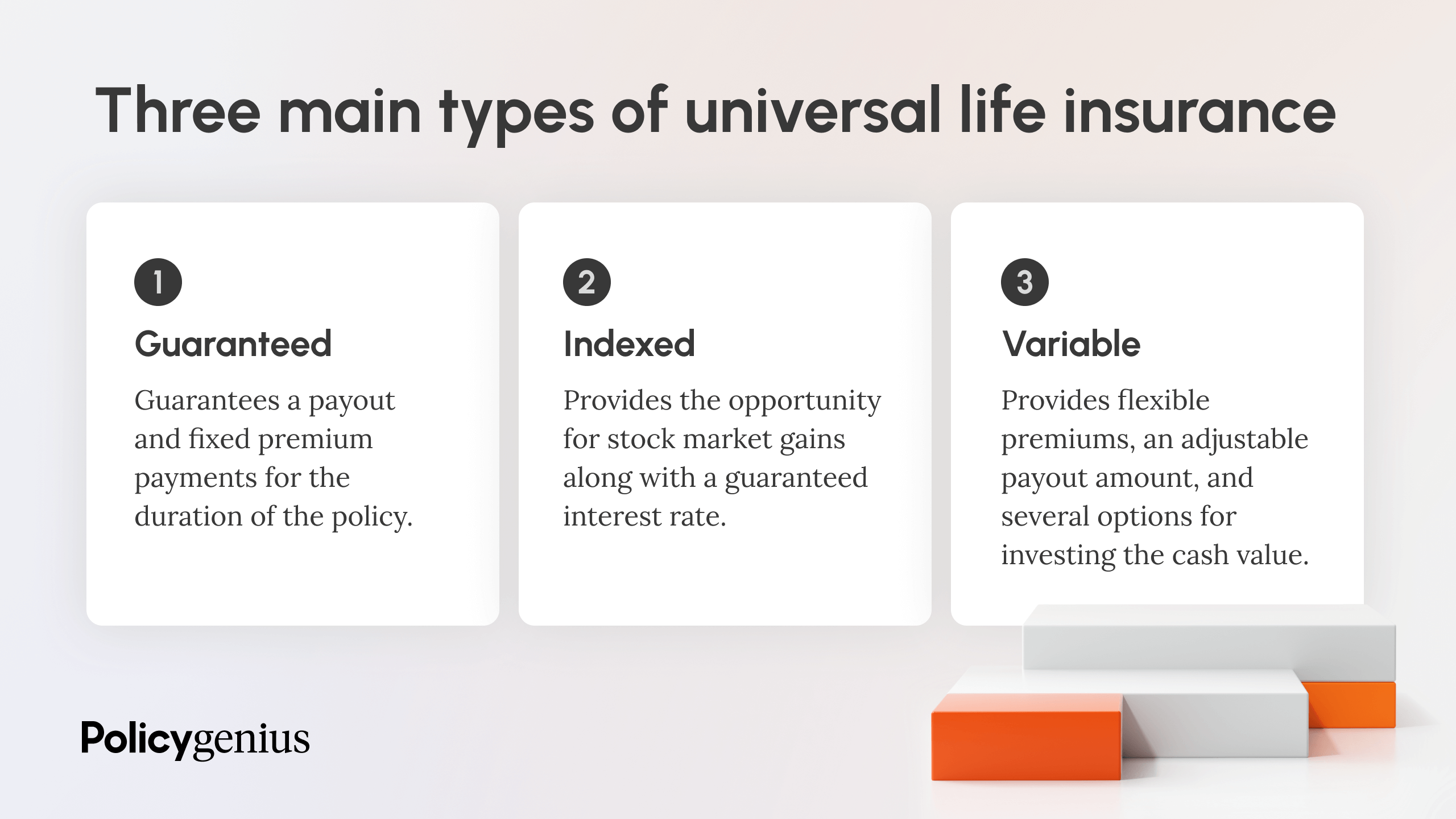

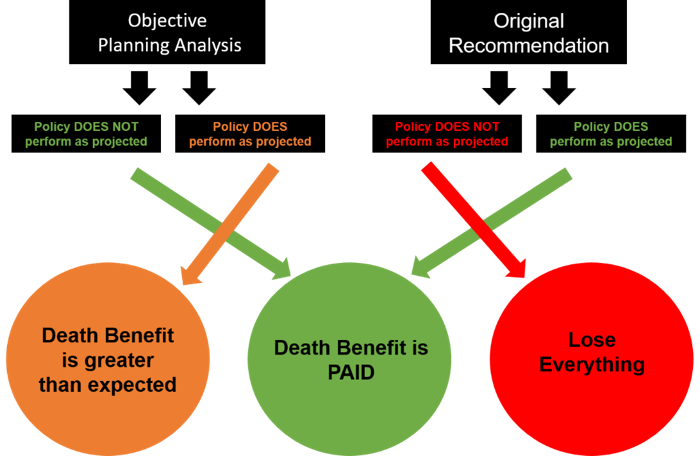

What if I told you that there was a product that could help Americans to get term and spend the difference, all with a single purchase? Right here is where I get simply downright bizarre. View closelyHave you ever before examined how indexed global life (IUL) insurance coverage technically works? It is a sort of money worth life insurance that has an adaptable premium repayment system where you can pay as long as you want to build up the cash money worth of your policy quicker (subject to specific restrictions DEFRA, MEC, TEFRA, etc). history of universal life insurance.

Latest Posts

Eiul Life Insurance

Aig Index Universal Life Insurance

Universal Term Life